Lions and friends…

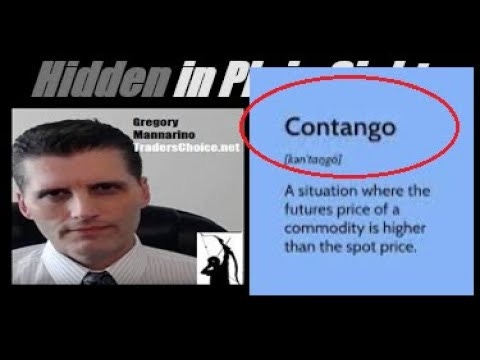

In my morning video below, I covered the current situation with crude- CONTANGO. With that, I wanted to outline CONTANGO in more detail.

Contango occurs when the futures price of a commodity, in this case crude oil, is bidding higher than the spot price. Spot price is the current price which you can buy it RIGHT NOW. Futures traders are placing bets that the future price of crude will be higher than the current spot price, and the immediate effect of contango is it drives the current price lower.

great example of contango(decay) nat gas. look the UNG and Boil 2x nat gas it takes long positions using derivatives. Regardles Crudes been trading as of lats between 73-78 dollar range. Will it break out? of course but only after "they" allow it. Knowledge is power. Its a casino.

Great explanation Greg, makes a lot of sense. I think another sign of this is that most oil stocks have fallen less than the actual oil spot price, which indicates that traders don’t think the spot price will remain this low long term