Lions and friends…

As of late, I have been buying shares of JEPI. (Click On That)

This investment seeks current income while maintaining prospects for capital appreciation. The fund seeks to provide the majority of the returns associated with its primary benchmark, the Standard & Poor's 500 Total Return Index (S&P 500 Index), while exposing investors to less risk through lower volatility and still offering incremental income. Under normal circumstances, the fund invests at least 80% of its assets in equity securities. It may also invest in other equity securities not included in the S&P 500 Index.

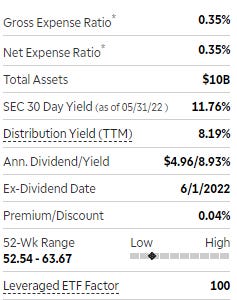

It pays a nice dividend, see table below.

The dividend is paid out monthly, with an ANNUAL yield as listed below.

I AM NOT SUGGESTING THAT ANYONE EITHER BUY OF SELL SHARES OF JEPI OR ANY OTHER SECURITY.

GM

New Robot Makes Soldiers Obsolete

https://www.youtube.com/watch?v=y3RIHnK0_NE

Interesting choice. I know you likely cannot do so, but I’d be interested in the why. Capital Appreciation? Dividend? Both?

Personally I’m content to sit in MSM, Max Safety Mode. Cash and metals equaling 85%, equities at 15%, all gold, silver, oil, LNG or other commodities based. Yes, I’ve gotten crushed since late February, down 32% from the high and 20% YTD. But from an overall perspective I’m only down maybe 5%. But I’m betting on a FED pivot at some point and when that happens gold, silver and oil will explode. Including the jr resource firms that are now in the capitulation phase on the chart. In my view, anyone that can figure out that the FED is going to pivot before they actually do can make a lot of money with minimal effort and no risk. Easier said than done.

But if we are ready with cash, and already have a store of metals, we can capitalize on most of the upside to come, completely negating the “loss” in cash to inflation. And if I’m wrong and there is no pivot, I’ve still protected the bulk of my assets and can develop a strategy from there.