Lions... A Picture Is Worth A Thousand Words. PRELUDE TO A "CREDIT SHOCK EVENT."

From Greg M

Lions…

Just last week The Fed warned of “Economic Shocks.” They think we forgot… BUT WE DIDN’T.

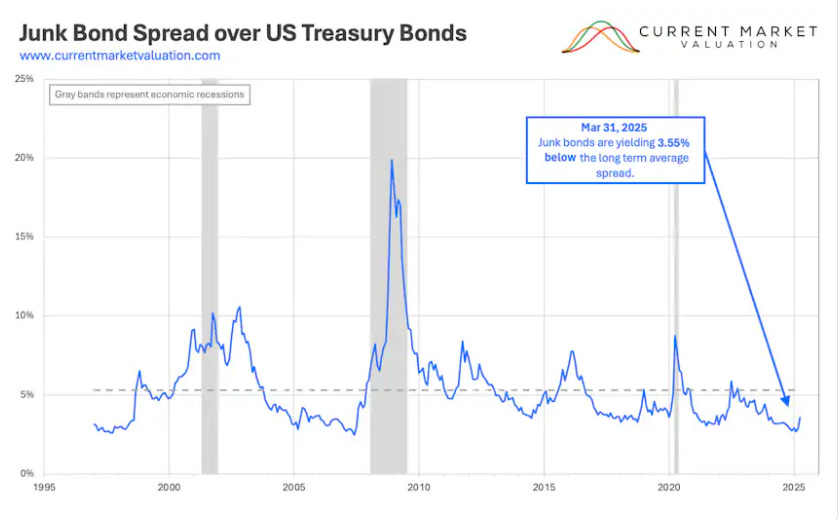

Look at this chart below.

(Source, Current Market Valuation). As of March 31, 2025, the spreads on junk bonds over treasuries are 3.55%, or 0.7 standard deviations below the historical norm.

Now… Here Is What That Means.

Investors Are ABSURDLY Complacent About Risk. This is now LaLa Land…

The obvious. Junk bonds (high-yield debt) carry significant default risk. Normally, spreads widen when the market senses stress.

The NOT so obvious? But at 3.55%, investors are saying… “We're not worried. We'll lend to risky companies nearly as cheaply as we lend to the U.S. government.” That is delusional IMO, especially in this macro environment. Right now we have record corporate debt, weakening fundamentals, rising bankruptcies, PLUS a fragile/weak consumer + slowing economy.

Historically, every time spreads get abnormally tight, LIKE NOW, a credit shock event follows. See 2000, 2007, 2014, 2018, 2020 all had tight spreads before volatility exploded. When spreads reverse and spike… it signals collapse in high risk corporate debt.

Lions… This can’t hold, it’s mathematically unstable.

What Happens Next? If history is any guide… Corporate downgrades & bankruptcies will rise, junk bond yields will spike. Then, equities/stocks will sell off. The junk market freezes, liquidity evaporates, and the dominoes start falling.

GM

Rough timeline?

"Absurdly Complacent" sort of describes this entire country right now. ALL of it sort of defies logic.