Taken from Option Alpha.

This is a strategy I have talked about many times in the past.. This article goes into detail on how to set these up. GM

Protective Put

A protective put is a single-leg options strategy combined with long stock that defines the underlying asset’s downside risk. Protective puts are also known as married puts because the long stock and long put are “married” together to protect against a potential decrease in the stock’s price.

Protective puts are similar to purchasing car insurance: a premium is paid to protect against future risk, but the hope is that it will never be needed. Like car owners, investors are willing to pay a relatively small amount on a recurring basis to guarantee defined risk.

Protective Put Outlook

A protective put is purchased when an investor owns an asset and wants to protect against future downside price movement. Owning the long put defines risk by allowing the investor to sell stock at the long put option’s strike price. A protective put can be entered below the price of the long stock position to limit loss. If the underlying asset has increased in price since its purchase, the protective put could be placed above the original purchase price of the stock to secure a profit.

Protective Put Setup

Put options are listed on the option chain at various strike prices and expiration dates. The closer to the money the put option is, the more expensive the options contract. The more time until expiration, the more expensive the options contract.

Purchasing a protective put will require paying a debit and will increase the cost basis of the original long stock position by the amount of the premium paid. An investor will need to consider these factors when deciding where he or she would like to protect their downside risk and for how long.

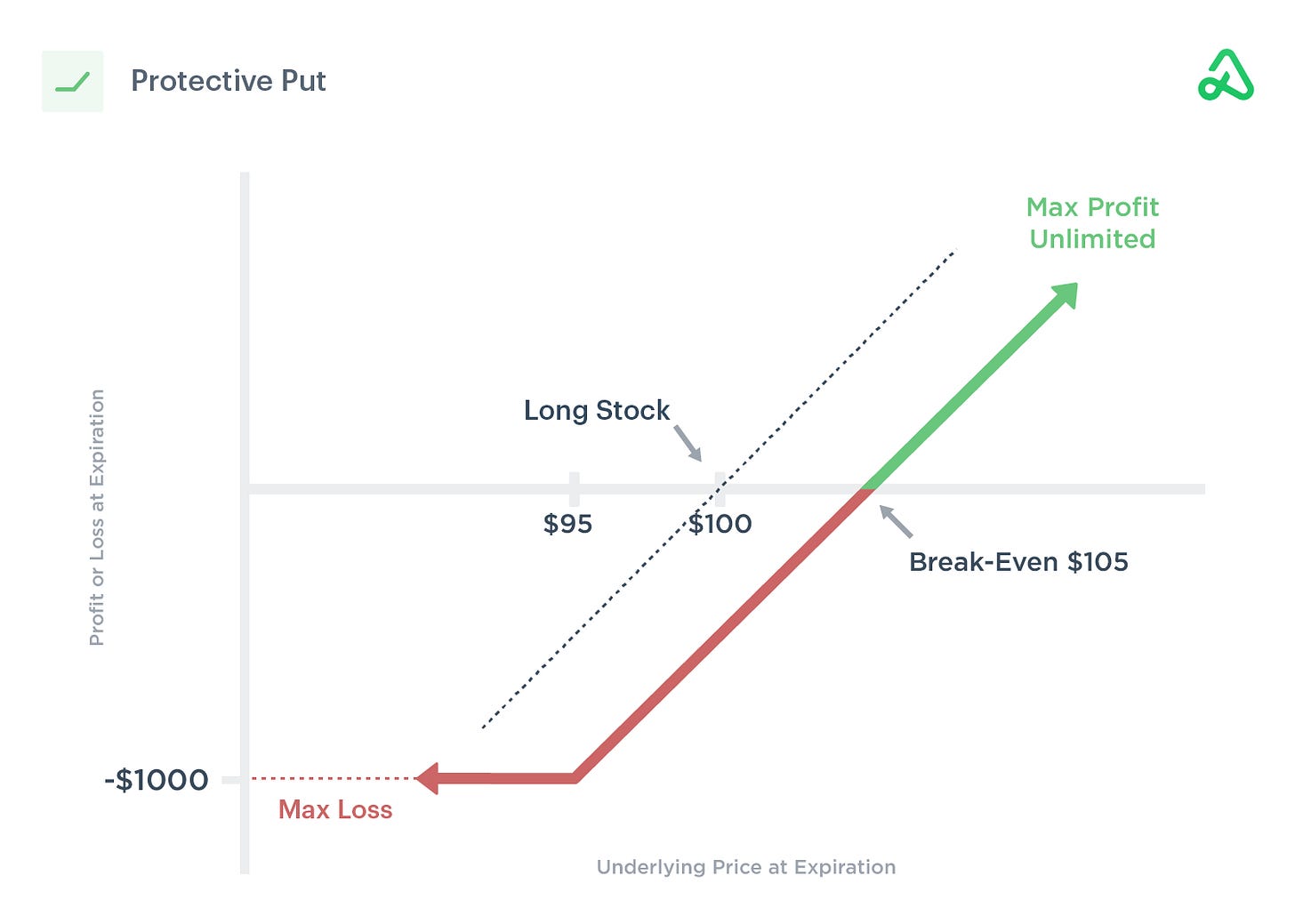

Protective Put Payoff Diagram

A protective put will have a payoff diagram similar in appearance to a single-leg long call option. The maximum profit potential is unlimited if the underlying stock moves up and stays above the protective put strike price. The downside risk will be limited to the long put option's strike price plus the cost of the premium to own the long put.

For example, if stock is owned at $100 and a protective put is purchased for $5.00 with a strike price of $95, the maximum risk for the position is $1000 per contract ($95 - $100 - $5 = -$10 x 100 shares per contract = -$1,000).

Entering a Protective Put

Entering a protective put position is very similar to opening a single long put option, but long stock is either already owned or purchased in conjunction with the protective put. Buying the long protective put will cost money and therefore increase the long stock position’s cost basis, but that is the compromise for protecting the underlying asset from downside risk.

For example, if stock is purchased at $100 and a protective put is purchased at the $95 strike price for $5.00, the long stock position’s cost basis becomes $105, meaning the stock will have to rally above $105 to realize a profit.

Exiting a Protective Put

Exiting a protective put will depend on where the price of the underlying asset is at expiration. If the stock price is above the protective put’s strike price, the put will expire worthless. If the stock price is below the protective put’s strike price, and the investor wishes to exercise the put option, 100 shares per contract will be sold at the strike price, and the position will be closed.

Time Decay Impact on a Protective Put

Protective puts have extrinsic value like all options. Time decay, or Theta, will slowly decrease the value of the contract’s premium. However, because protective puts are purchased for protection and not speculation, time decay is not as important. Ideally, since long stock is owned, the goal for a protective put is to see the price of the stock increase, and the protective put expire worthless.

Implied Volatility Impact on a Protective Put

Implied volatility will have an impact on the pricing of protective puts. The higher the value of implied volatility, the more expensive the cost of the put option. Generally speaking, put options are more expensive than call options because investors are willing to pay a higher premium to protect from downside risk. When markets experience large price movements, implied volatility increases, and the cost of put options typically increases.

Adjusting a Protective Put

Protective put options positions can be managed during a trade as the price of the underlying stock moves. If the stock price rises, an investor may choose to move up the protective put to secure selling shares at a higher price.

To do so, a sell-to-close (STC) order would be entered to exit the original long put option position. This would collect a credit, but typically at a lower price than the option was originally purchased. A buy-to-open (BTO) order would be entered for a new long put option with a higher strike price. This will cost more than the put option that was sold, and the total amount debited would be added to the original premium paid to create a new cost basis. However, if the stock price has rallied high enough, the protective put could still guarantee a profit, even with the debits.

For example, if stock is owned at $100 and a protective put is purchased for $5.00 with a strike price of $95, and the stock subsequently increases to $120, the original $95 put may be sold (for less credit than was initially paid) and a new put may be opened at $115. If the new protective put costs an additional $5.00, the position would still guarantee a profit of at least $500.

Rolling a Protective Put

Protective put options that expire out-of-the-money at expiration have no value. To initiate a new protective put contract, a long put can be purchased for a future expiration date at the same strike price or a different strike price depending on where the underlying stock is trading.

Suppose the put is in-the-money at expiration, and the investor does not want to exercise their right to sell at that price (perhaps believing the stock will continue to rally in the future). In that case, the options contract can be rolled out to a future date by selling the original position and purchasing a new long put.

Hedging a Protective Put

Protective puts may be hedged to reduce the overall cost of the position. A short call can be sold above the stock price to collect a credit. This will limit the upside potential of the underlying stock position, but the premium received can offset the cost of the protective put. This is called a collar strategy.

The S&P is within a whisper of breaching bear market trading via intraday trading. As of 12:20 pm EST, 3845.91. It will be interesting if it closes at 3837 by the close. How exciting. This is more fun than wrestling with pigs in the pigpen.

imo it's not the time anxmore to think about protectice put strategies, think it's time to look for buying opportunities. Novenber 2021 or January 2022 would have been the time for these protectice puts.