Lions and friends…

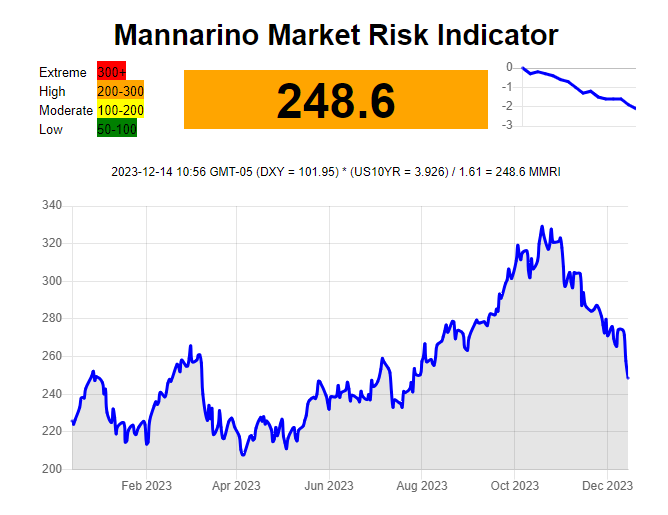

As we called/expected, the MMRI has now dropped below 250.

As I am writing this the US 10 Year Yield stands at 3.95%, and going lower IMO.

The DXY (dollar index) is 102.08.

So what does this mean?

The Fed. is setting the stage for a MASSIVE stock market PUMP, which will only exacerbate the already MONUMENTAL distortions which already exist in the market.

As we have covered in my YouTube videos, 2024 is going to be EPIC! And central banks are going to BUY IT ALL.

Be Ready.

GM

It isn't a stock market pump, it is just they have made the decision to destroy the FRN. As of Jan, 2024 the Fed knows the petro dollar status ends with OPEC. Thus, many countries will be at the Fed window throwing these dollars back at them- many countries won't need to use them any longer. That spikes interest rates almost overnight. The FRN is done. You can have stocks go to infinity- won't matter.. once you cash them out you won't have any purchasing power. The goal here is to own nothing, not make everyone a 401K millionaire

I am posting this article here. It is a really good article about the housing market, mom and pops, Black Rock and a new bill just introduced.

https://www.armstrongeconomics.com/markets-by-sector/real_estate/get-ready-for-a-1986-repeat-of-a-real-estate-crash/